It's necessary to check car insurance status online to make sure your car is always up to date, whether you drive a lot or just occasionally. Your car needs to be continuously covered by insurance, and it's crucial to know when your policy expires.

This article will show you how to easily check your car insurance status online, so you can keep your vehicle protected without any hassle. Let's see the different processes to check vehicle insurance status online.

There are so many ways to check car insurance status online and to know about the details of the expiry date. Here we have mentioned some of the ways to check car insurance status online:

• Check your insurance papers: Take a look at the physical copy of your car insurance. It has information about when your policy is valid and when it expires.

• Call customer support: Call your insurance company's customer support and they can tell you exactly when your car insurance ends.

• Talk to your agent: If you got your insurance through an agent, reach out to them. They can quickly tell you when your policy expires.

• Insurance Information Bureau (IIB) website: Go to the Insurance Information Bureau (IIB) website. You can easily find out the status and expiration date of your car insurance there.

• Parivahan Sewa website: Check the Parivahan Sewa website to see the status of your car insurance.

• VAHAN App: Use the VAHAN App to quickly and efficiently check your car insurance status.

• Regional Transport Office (RTO) website: Explore your Regional Transport Office (RTO) website. It often lets you check your car insurance status.

You can easily check the status of your vehicle insurance online on Parivahan Sewa, the centralized website maintained by the Ministry of Road Transport & Highways, follow these simple steps:

Step 1: Visit the official website of “Parivahan Seva”, find the “Informational Services” tab on the menu bar, and choose “Know your Vehicle Details” from the drop-down menu.

.png)

Step 2: You will be redirected to the “Citizen Login” page. Here login into your account with your mobile number or create a new one.

Step 3: Once you log in, fill in your registration number and click on “Search Vehicle”.

Step 4: Now, you can see the details of your car along with its insurance expiry date.

To easily check your Vehicle Insurance details by using the mParivahan app, you have to follow these simple steps:

Step 1: Install the mParivahan app, choose your preferred language, and click on 'Continue.'

Step 2: On the dashboard, select your car registration number or Driving License number as the verification method

Step 3: Enter the details, click on 'Search' to proceed, and, sign in with your registered mobile number.

Step 4: Once signed in, you can view and confirm the validity of your car insurance policy directly through the app.

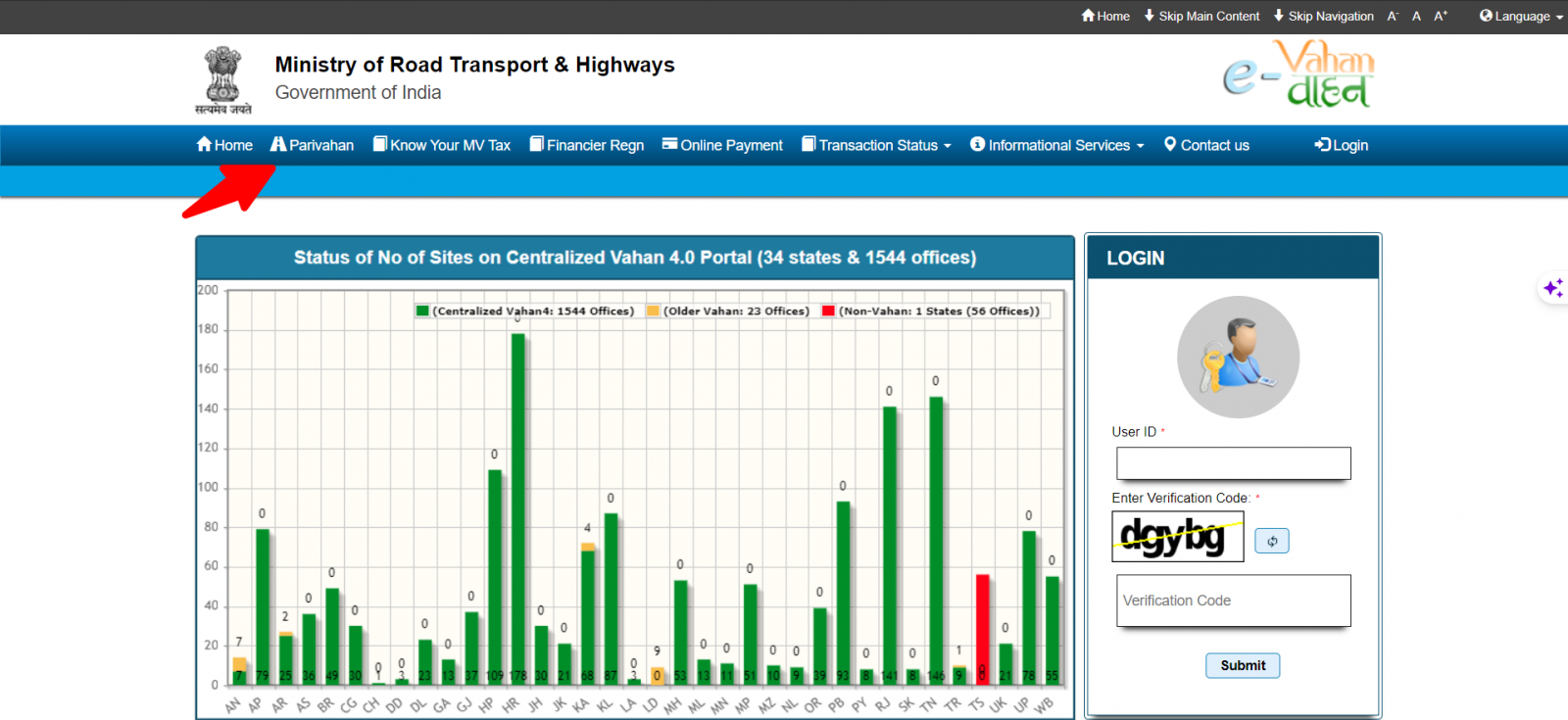

Checking your Car insurance status on the VAHAN web portal is another convenient option. Here are the steps to follow:

Step 1: Visit the “Vahan” portal, and click on the “parivahan” icon.

Step 2: On “Parivahan Seva”, find the “Informational Services” tab on the menu bar, and choose “Know your Vehicle Details” from the drop-down menu.

Step 3: Enter your Mobile Number to log in, or “Create a new account”. Once you log in to the portal, enter the registration number of your car.

Step 4: Now, you can find all the details of your vehicle including your car insurance details.

Note: Sometimes there might be a delay in updating car insurance information on the VAHAN portal or the mParivahan app. If you face any issues, you have to wait for around 30 days to reflect the details of your policy on the portal after it has been issued.

To check your car/vehicle insurance status online on the Information Bureau of India (IIB) portal, here's a step-by-step guide:

Step 1: Go to the “IIB Portal” and fill in the necessary details like vehicle registration number, address, date of the accident, mobile number, and your name.

Step 2: Click on the “Submit” button to proceed further.

Step 3: Once you submit the form, the portal will display the details of your vehicle insurance status.

To find out when your four-wheeler insurance policy expires, you can easily check the information on your Regional Transport Office (RTO) website. Here's a simple guide on how to do it:

Visit the official website of your State's transport office and find “Online Services - For Citizens”.

Select “Vehicle-Related Online Services”, and select the details of the RTO where your car is registered.

Access the “Status” tab, choose “Know your Vehicle Details”, and provide vehicle information.

Now, the website will display the details of your vehicle, including the expiry date of your car insurance policy.

Note: As you know the importance of checking car insurance status online. Therefore, it’s advisable to buy car insurance from the best car insurance companies.

In addition to online options, you can also check your car insurance status offline, and it's pretty simple. Just follow these steps:

• Visit the RTO: Go to the Regional Transport Office where your vehicle is registered.

• Provide your registration number: Give the RTO authorities your vehicle's registration number.

• Get the information: The RTO will give you all the important details about your car insurance policy.

If you got your vehicle insurance through Okbima, checking your policy status online is easy. Just follow these steps on the Okbima website:

Step 1: Visit the website of Okbima, and Log into your account.

Step 2: Once successfully logged in, access your account dashboard and choose the motor policy.

Step 3: Now, you can see the current status of your policy, along with other important details.

Understanding whether your vehicle has valid insurance is important because it's against the law to drive without it. According to The Motor Vehicles Act, every vehicle must have at least a Third-party Liability Insurance Plan.

Nowadays, it's easy and quick to check your insurance status online, and here's why it matters:

• Timely policy renewal: Checking your insurance status online helps you renew your policy on time. This ensures that you always have coverage and are following the law.

• Avoid penalties and fines: If you know the insurance status, you can avoid the penalties and fines that have to pay while driving without valid insurance.

• Continuous coverage: Regularly checking your insurance status makes sure you always have coverage against third-party and financial responsibilities in case of accidents or damage to your vehicle.

Renewing your car insurance before it expires is important to keep your vehicle continuously covered. If you don't renew on time, there can be serious consequences, such as:

• No Claims Coverage: If your insurance lapses, your insurer won't cover any losses or damages from your vehicle. You'll have to pay for repairs or compensate others on your own, causing potential financial trouble.

• Violation of Motor Laws: Car insurance is mandatory in India, and your vehicle must have at least third-party coverage. If you get caught driving without insurance, you have to pay a fine of Rs 2,000 and/or imprisonment for up to six months.

• Higher Renewal Premium: If your policy ends, then insurers may see you as a higher risk, and that will lead to a potentially higher renewal premium. Your vehicle may also undergo inspection during renewal, revealing increased liabilities that contribute to a higher premium.

• Loss of No Claim Bonus (NCB): NCB is a discount for every claim-free year, potentially saving you up to 50%. But if you don't renew within 90 days of the expiry date, you lose this bonus.

In conclusion, making sure you renew your car insurance on time is crucial to avoid potential issues like a higher renewal premium and the risk of your claims being rejected. If you're unsure about your policy's expiry date, there are convenient options available to check your car insurance status online.

You can use resources such as the Parivahan Sewa website, the mParivahan app, the VAHAN portal, or reach out directly to your Regional Transport Office (RTO). Be proactive, stay informed, and prioritize the timely renewal of your car insurance policy to keep your vehicle protected.