Unit-Linked Insurance Plans (ULIPs) come with a dual advantage of investment plans and life insurance, but understanding ULIP charges is crucial when considering these plans. These charges are fees levied by the insurance company for managing and administering the ULIP. Being aware of these charges can help you make informed decisions about your investment.

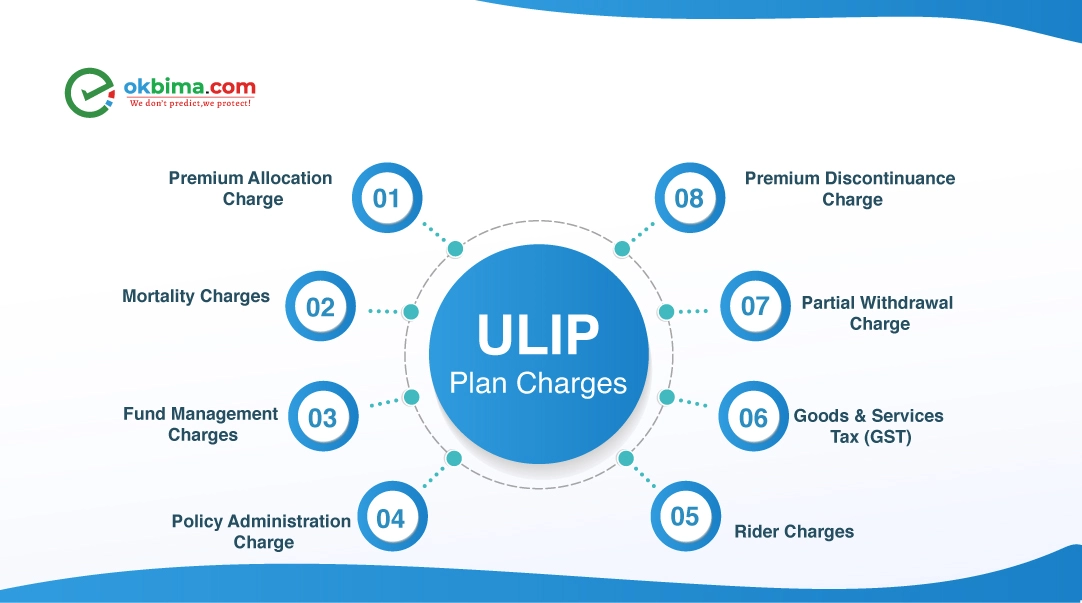

Let’s explore the 14 ULIP charges names and types you must know to better understand how your investment is allocated and managed.

ULIP plan charges are the costs associated with the various services provided by the insurance company. These charges are typically deducted from the premium amount or by cancelling units from the ULIP fund. Here’s why understanding these charges is critical:

1. Transparent Investment Planning: Knowing the charges ensures you can assess the net returns from your ULIP plan.

2. Comparison of Plans: Different ULIP plans and insurers have varying charges, which affect the overall performance of your investment.

3. Informed Decision-Making: Awareness of charges prevents unpleasant surprises and helps align the investment with your financial goals.

Check ULIP Plans Today —- Compare Now

Premium allocation charges in ULIP are a percentage of the premium deducted upfront before the funds are invested. These charges cover:

Medical tests

Underwriting

Commission fees

This charge is primarily applicable to the first premium payment and ensures the smooth initiation of your policy.

Mortality charges are levied to provide life cover under the ULIP. These charges depend on factors like:

Age of the policyholder

Health conditions

Mortality tables used by the insurer

The premium amount is adjusted accordingly to ensure life cover protection.

Fund management charges in ULIP are fees for managing your investments. They vary based on the type of fund:

Equity-oriented funds typically attract higher charges.

Debt-oriented funds have comparatively lower charges.

The maximum permissible charge is 1.35% of the fund value as per regulatory norms.

These monthly charges cover administrative costs, such as:

Policy maintenance

Bookkeeping

Sending policy updates

This charge is deducted by cancelling units from your ULIP fund.

If you stop paying premiums during the lock-in period (usually five years), your funds are moved to a discontinuance policy fund. The charges include:

A fee for discontinuance during the lock-in period.

No surrender fees after the lock-in period.

After the lock-in period, you can make partial withdrawals from your ULIP fund. However, this is subject to:

Charges for each withdrawal

Limits on the withdrawal amount and frequency

These terms vary across insurers.

Services like policy administration, premium allocation, and fund switching attract GST. The applicable rate depends on the prevailing tax laws.

You can enhance your ULIP coverage with riders like critical illness or accidental death benefits. However, adding these riders comes with additional ULIP charges.

If you need to surrender your ULIP before the lock-in period ends, you must pay surrender charges. These charges are waived if you surrender after the lock-in period.

ULIPs allow you to switch between funds (e.g., equity to debt) based on market conditions. Insurers may levy a fee for such switches after a specified number of free switches.

Invest In The Best ULIP Plans – Start Now

If you wish to redirect future premiums to a different fund, insurers may charge a fee for this service. For instance, you may move funds from a low-return fund to a high-return fund.

You can invest additional amounts in your ULIP above the regular premium. This requires paying a top-up charge, allowing you to maximize returns.

Some ULIPs offer guaranteed returns after a specific period. To avail of this benefit, insurers levy guarantee charges.

These charges cover services like:

Updating contact details

Changing the premium payment method

Miscellaneous fees vary across insurance providers.

Apart from the charges in ULIP plan, It also provides tax benefits under the Income Tax Act:

1. Tax Deduction Under Section 80(C)

Premiums paid up to ₹1.5 lakhs per annum are tax-deductible.

2. Tax Exemption Under Section 10(10D)

Maturity benefits are tax-free if the premium is less than ₹2.5 lakhs.

Policies exceeding ₹2.5 lakhs are taxable as per the 2021 tax amendment.

3. Tax Benefits Based on Policy Term

Policies purchased before April 1, 2012: Premiums less than 20% of the sum assured qualify for tax exemptions.

Policies between April 1, 2012, and February 1, 2021: Premiums less than 10% of the sum assured are exempt.

4. Tax-Free Death Benefits

The sum received by nominees in case of the policyholder's demise is entirely tax-free.

5. Partial Withdrawals

Withdrawals up to 20% of the fund value are tax-free after the lock-in period.

6. Capital Gains Tax

Equity-oriented ULIPs with returns exceeding ₹1 lakh are taxed at 10%.

Other investments attract a 20% tax rate.

Increase Your Returns With The Right ULIP Plan – Get Expert Help

When choosing a ULIP, consider the following:

1. Understand the Charges: Evaluate all ULIP charges, including premium allocation, fund management, and surrender charges.

2. Check the Lock-in Period: Ensure the lock-in period aligns with your financial goals.

3. Assess Fund Options: Look for ULIPs offering a diverse range of fund options for optimal returns.

4. Compare Insurers: Compare different insurers to find one with minimal charges and excellent services.

5. Review Tax Benefits: Opt for a ULIP that maximizes tax savings under the current tax laws.

ULIPs offer a unique combination of insurance and investment. However, understanding ULIP charges is essential to maximize returns and avoid surprises. Knowing about premium allocation charges, fund management fees, and other costs ensures transparency in your investment. Before investing in a ULIP, thoroughly analyze all charges and benefits to make an informed decision.

For expert advice and the best ULIP plans, reach out to OkBima — your trusted insurance partner.