There are 23 life insurance companies in India officially registered with the Insurance Regulatory and Development Authority of India (IRDAI). These companies offer various life insurance policies, establishing a contractual agreement between an individual and the insurer. In the event of an unexpected demise during the policy term, the insurer commits to providing a death benefit to the policyholder's family.

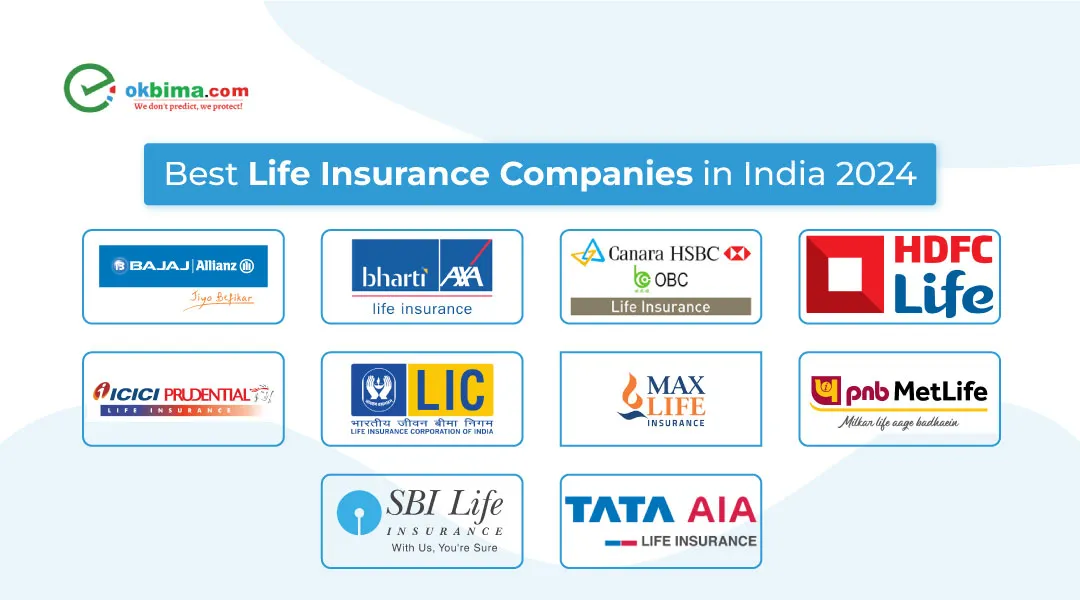

Here is the best life insurance companies in India list based on the claim settlement ratio in 2022-2023 (issued by IRDAI). With this list, you can select the best life insurance company for 2024 as per your needs.

|

Life Insurance Companies |

Claim Settlement Ratio (CSR) 2022-23 |

|

|---|---|---|

|

Max Life Insurance |

99.35% |

|

|

Bharti Axa Life Insurance |

99.05% |

|

|

Life Insurance Corporation of India (LIC) |

98.62% |

|

|

Bajaj Allianz Life Insurance |

98.48% |

|

|

PNB MetLife Insurance |

98.17% |

|

|

Tata AIA Life Insurance |

98.02% |

|

|

HDFC Life Insurance |

98.01% |

|

|

ICICI Prudential Life Insurance |

97.90% |

|

|

Canara HSBC Life Insurance |

97.10% |

|

|

Shriram Life Insurance |

95.12% |

|

|

SBI Life Insurance |

93.09% |

Here are the top 10 life insurance companies in India based on their claim settlement ratio (CSR), and offered plans. You can choose the best one according to your needs.

Mitsui Sumitomo Insurance Co. Ltd. and Max Financial Services Ltd. collaborated to establish "Max Life Insurance." With 15 years of experience, Max Life Insurance has a strong track record and is known for its excellent investment expertise, providing a one-stop solution for various insurance and investment needs.

Plans Offered by MAX Life Insurance Company:

• Long-term Protection Plan

• Saving Plans

Bharti AXA Life Insurance, located in Mumbai, offers both life and general insurance. It's a joint venture between Bharti Enterprises and the AXA Group. In FY 2020-21, the company achieved a remarkable milestone with a 99.05% claim settlement ratio, ensuring that the maximum number of claims were settled to customers' satisfaction. The policies they offer can have a maximum tenure of 65 years, and the age criteria for these plans range from a minimum of 18 years to a maximum of 65 years.

Plans Offered by Bharti AXA Life Insurance Company:

• Child Plans

• Retirement Plans

The Life Insurance Corporation of India, established in 1956, is India's oldest insurance provider. As a government-owned entity, it's not only one of the largest insurance companies but also serves as an investment firm. LIC offers a range of insurance products with a huge workforce, LIC operates in numerous cities and towns throughout the country.

Plans Offered by Life Insurance Corporation Of India:

• Life Insurance

• Pension Plans

• Unit-linked Plans

Bajaj Allianz Life Insurance is a collaboration between the European financial services company Allianz SE and Bajaj Finserv Limited. Established in 2001, this life insurance company offers an easy solution for customers' insurance requirements, helping them achieve their financial goals. The company offers a wide range of products according to the customers' specific needs and provides innovative services.

Plans Offered by Bajaj Allianz Life Insurance:

• Retirement Plans

• ULIP Plans

PNB MetLife India Insurance Company serves clients across 117 locations throughout India and is known for its protection and retirement products. PNB MetLife Insurance Company in India was established in 2001. For the insurance products offered by the company, the eligibility criteria range from a minimum age of 18 to a maximum of 65 years old.

Plans Offered by PNB MetLife India Insurance Company:

• Savings Plans

• ULIP Plans

• Monthly Income Plans

• Money-back Plans

TATA Sons and the AIA Group have joined hands to launch the TATA AIA Life Insurance Company. The company adopts a customer-centric approach and offers a wide range of insurance products to individuals, associations, and corporate insurance buyers.

Plans Offered by TATA AIA Life Insurance Company:

• Child Plans

• Wealth Plans

• Protection Plans

• Savings Plans

HDFC Life Insurance Company India, established in 2000, is a joint venture between Housing Development Financial Corporation Ltd. and Standard Life Plus. They offer a wide range of portfolios, 38 individual and 13 group insurance products to serve various customer needs.

Plans Offered by HDFC Life Insurance Company:

• Pension Plans

• Savings Plans

• Protection Plans

• Women's Plans

ICICI Prudential Life Insurance Company of India, established in December 2000, is a joint venture between ICICI Bank Ltd. and Prudential Plus. As the first private-sector life insurance company in India, it has consistently held the top position among private life insurers for over a decade. The company offers a range of products to meet various buyers' requirements, helping customers achieve their long-term goals.

Plans Offered by ICICI Prudential Life Insurance Company:

• Term Plans

• ULIP plans

• Pension Plans

• Child Plans

Canara HSBC Life Insurance, established in 2008, is a joint venture between HSBC Insurance Holding Ltd, Canara Bank, and Oriental Bank. This company operates in a pan-India network, having 7,000 branches of the three shareholder banks across the country. Additionally, they offer essential training to bank staff at 28 centers throughout India.

With a huge customer base, the company offers customized insurance products to meet the specific needs of buyers. The policies they offer come with a maximum tenure of 40 years, and eligibility criteria range from a minimum age of 18 years to a maximum of 70 years.

Plans Offered by Canara HSBC OBC Life Insurance Company:

• ULIP Plans

• Child Insurance Plans

• Group Insurance

SBI Life Insurance Company, established in 2001, is a joint venture between the State Bank of India and BNP Paribas Cardif. It offers comprehensive products at competitive rates. You have the option to purchase SBI life insurance plans both online and offline, making it convenient for customers.

Plans Offered by SBI Life Insurance Company:

• Pension Products

• Protection Plans

Choosing the best life insurance company in India requires careful consideration of various factors to ensure that your coverage meets your needs and offers reliability.

Some key steps to guide you in selecting the right life insurance provider:

• Research and Compare: Start by researching the different life insurance companies in India. Look into their policies, coverage options, premium rates, and claim settlement ratios. Use online resources, reviews, and ratings to compare companies.

• Check IRDAI Registration: Verify that the insurance company is registered with the Insurance Regulatory and Development Authority of India (IRDAI). This ensures that the company complies with regulatory standards and guidelines.

• Financial Stability: Check the financial stability of the insurance company. A financially sound company is more likely to fulfill its commitments over the long term. Check their financial ratings and stability reports from credit rating agencies.

• Coverage Options: Evaluate the range of life insurance products offered by each company. Choose a company that provides coverage options aligned with your specific needs, whether it's term insurance, whole life, or endowment plans.

• Claim Settlement Ratio: Check the life insurance company's claim settlement ratio which indicates a better track record of settling claims, ensuring that your beneficiaries will receive the death benefit promptly.

• Premiums and Affordability: Compare premium rates across different companies. Consider your budget and choose a company that offers competitive premium rates while providing the necessary coverage.

• Customer Service: Check the quality of customer service provided by the insurance company. A responsive and supportive customer service team can be crucial when you need assistance, especially during the claims process.

Confused How Can You Select Best Life Insurance Companies? Contact Our Experts!

When it comes to securing your family's financial future, choosing the right life insurance company is necessary. Among the many options available, Okbima stands out as a top choice for several reasons.

Affordable Premiums: Life insurance involves a long-term commitment. Okbima offers affordable premiums and a range of plans for various budgets.

Flexible Policy Options: Okbima provides various policy choices like term, whole, and universal life insurance to match your financial goals and family's needs.

Ease of Application: Life insurance applications can be lengthy, but Okbima eases the process with its user-friendly online platform.

Outstanding Customer Service: In life insurance, reliable support is important. Okbima's customer service ensures a smooth journey with a team of knowledgeable professionals.

Transparency and Trustworthiness: Trust is very important in life insurance. Okbima's clear policies and procedures build trust and provide reassurance to policyholders.

Whether it's saving for long-term goals, protecting your family from financial emergencies, or simply optimizing your tax situation – the right plan with the right insurance company can prepare you for any situation. I've compiled a list of the top 10 insurance companies based on their high claim settlement ratios to simplify your selection process. These companies are known for efficiently meeting consumer expectations.

Note: If you find yourself still unsure about choosing the right insurance company that aligns with your financial goals, Okbima is here to assist you.

Life insurance companies are financial institutions that provide insurance policies to individuals, offering financial protection and security to beneficiaries in the event of the policyholder's death.

Life insurance companies make money by charging premiums to policyholders in exchange for providing coverage and benefits in the event of the insured person's death.

Yes, life insurance companies can go bankrupt if they experience significant financial losses or mismanagement.

Yes, life insurance companies can go bankrupt if they face significant financial losses or mismanagement of funds.

Based on the Claim Settlement Ratio (CSR) for the financial year 2021-22, the top life insurance companies are Max Life Insurance, HDFC Life Insurance, Tata AIA Life Insurance, and Exide Life Insurance.

India has a total of 24 life insurance companies that offer a variety of products to fill different needs and budgets.

Many life insurance companies in India provide customizable policies to choose specific coverage options, riders, and sum assured based on their requirements.

Yes, the life insurance companies provide life insurance plans online as well as offline.

Max Life Insurance has the highest claim settlement ratio in terms of the number of claims with 99.34% for the year 2021-22.

The No. 1 life insurance company in India is the Life Insurance Corporation of India (LIC).

The top 10 life insurance companies in India are Max Life Insurance, Bharti Axa Life Insurance, Life Insurance Corporation of India (LIC), Bajaj Allianz Life Insurance, PNB MetLife Insurance, Tata AIA Life Insurance, HDFC Life Insurance, ICICI Prudential Life Insurance, Canara HSBC Life Insurance, and Shriram Life Insurance.

Acko Life Insurance Ltd. and Credit Access Life Insurance Ltd. are the two new life insurance companies.

The Oriental Life Insurance Company is the oldest life insurance company in India, founded in 1818.