Ayushman Bharat Yojana Scheme, also known as the Pradhan Mantri Jan Arogya Yojana (PMJAY) Scheme , is a government initiative in India aimed at providing healthcare coverage to economically vulnerable families. Launched in 2018, this scheme seeks to address the issue of financial hardships faced by individuals when seeking medical treatment.

Ayushman Bharat Yojana Scheme, also known as Pradhan Mantri Jan Arogya Yojana (PM-JAY), is a healthcare scheme launched by the Government of India. The program was announced in September 2018 and became operational on September 23, 2018. Ayushman Bharat aims to provide financial protection and improve access to quality healthcare for the economically vulnerable population in India.

The Ayushman Bharat Yojana Scheme is a healthcare initiative launched by the Government of India. The scheme aims to provide financial protection and healthcare access to economically vulnerable families.

Financial Protection: Ayushman Bharat Card provides health insurance coverage of up to INR 5 lakh per family per year, offering significant financial protection against healthcare expenses.

Cashless Transactions: The Ayushman Bharat Card ensures cashless transactions at hospitals, allowing beneficiaries to receive healthcare services without having to make direct payments at the time of treatment.

Wide Network of Hospitals: The scheme has a network of public and private hospitals across India. Beneficiaries can access healthcare services from these hospitals, both urban and rural healthcare development.

Preventive Healthcare Services: Ayushman Bharat Card special importance on preventive healthcare by covering pre-hospitalization and post-hospitalization expenses.

Empowerment of Women: The scheme prioritizes women by ensuring that they are named as the primary cardholders in eligible families.

Ayushman Bharat PMJAY scheme provides financial protection to over 10.74 crore vulnerable families, covering approximately 50 crore individuals, providing coverage of up to Rs 5 lakh (per family per year).

Some of the common treatments that are covered under the Ayushman Bharat Yojana Scheme include:

• Medical and Surgical Procedures: The scheme covers a wide range of medical and surgical procedures, including but not limited to cancer treatment, heart surgeries, joint replacements, kidney treatments, and more.

• Maternity and Newborn Care: Maternity-related expenses, including normal and cesarean deliveries, are covered under the scheme. Newborn care is also included.

• Pre-existing Conditions: Ayushman Bharat Card covers pre-existing conditions, ensuring that individuals with existing health issues can also avail of benefits.

• Emergency Room Care: Emergency hospitalization is covered under the scheme, providing financial support during critical situations.

• Follow-up Care: The scheme covers post-hospitalization expenses, including follow-up consultations and medications.

Ayushman Bharat PMJAY scheme covers a broad range of treatments, there may be some exclusions and limitations. Here are some treatments that are not covered:

• Outpatient Care: Ayushman Bharat Card primarily covers inpatient hospitalization expenses. Outpatient care and treatments that do not require hospitalization may not be covered.

• Cosmetic Procedures: Procedures that are primarily cosmetic and not medically necessary are generally not covered.

• Non-Allopathic Treatments: Ayushman Card typically covers treatments under allopathic (modern medicine) systems. Non-allopathic treatments may not be covered

• Non-Hospital Expenses: The scheme is focused on hospitalization expenses. Costs related to outpatient consultations, diagnostic tests outside the hospital, and non-hospital settings may not be covered.

Under the Ayushman Bharat Yojana Scheme, each eligible family receives coverage of up to Rs. 5 lakh per family per year for hospitalization expenses. This means that if a member of the eligible family requires hospitalization for a covered medical condition or procedure, the insurance coverage provided by the Ayushman Bharat Card can be utilized up to the specified limit of ?5 lakh. The coverage includes a wide range of medical and surgical procedures.

To use the Ayushman Bharat card in a hospital, follow these general steps. The processes may vary depending on the hospital and region, so it's advisable to confirm the specific procedures with the hospital staff.

Check Hospital List: Make sure the hospital is approved to offer services under the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY). Only approved hospitals can participate in the program.

Carry Ayushman Bharat Card: Show your Ayushman Bharat card (also known as the Ayushman Gold Card) at the hospital's registration desk when you visit for treatment.

Verification and Authorization: The hospital staff will verify the details on the Ayushman Bharat card. Once the eligibility is confirmed, the hospital will seek authorization from the Ayushman Bharat system for the proposed treatment.

Medical Treatment: If the treatment is authorized, you can proceed with the required medical procedures. The hospital will provide the necessary healthcare services as per the treatment plan.

Claim Processing: The hospital will process the insurance claim with the Ayushman Bharat system. This involves submitting the necessary documentation and details of the treatment provided.

Cashless Treatment: The Ayushman Bharat Card generally operates on a cashless basis, meaning that the hospital bills are settled directly between the hospital and the Ayushman Bharat system.

Post-Treatment: After the treatment, it's important to keep any relevant documents provided by the hospital for future reference. This may include discharge summaries, prescriptions, and any other documents related to the hospitalization.

The Ayushman Card offers health insurance that lasts for one year. Each eligible family can get coverage up to ?5 lakh per year. This money is meant to help with hospital expenses for different medical treatments. You can use the Ayushman card as many times as needed within the one-year coverage period. But once you've used up the ?5 lakh for that year, you have to wait until the next year for more benefits.

You can check your Ayushman Card Balance by using the PMJAY website, the UMANG app, and the Ayushman Mitra Helpline.

Step 1: Visit the official PMJAY website, and click on "Am I Eligible?"

Step 2: Enter your mobile number, click on verify, and enter the OTP and captcha code.

Step 3: Once, you log in, you can able to see details like your family members covered under the scheme, available treatments, and previous hospitalizations.

Step 1: Download the UMANG app on your phone.

Step 2: Register or log in using your mobile number and Aadhaar card details, and search for "Ayushman Bharat PMJAY".

Step 3: Click on "Beneficiary Status" and enter your mobile number or Ayushman card number.

Step 4: You'll get information about your family's coverage and any previous claims.

Step 1: Call the toll-free Ayushman Mitra helpline number 1800-111-565.

Step 2: Provide your Ayushman card number or any other necessary details.

Step 3: The helpline personnel can assist you with your queries about coverage, treatment availability, and claim status.

A health card and an Ayushman card are two different types of healthcare cards available in India. A health card is usually provided by insurance companies or employers and provides coverage for medical expenses depending on the policy.

On the other hand, an Ayushman Yojana card is issued by the government and provides free health insurance coverage for low-income families under the Ayushman Bharat Yojana scheme.

|

Feature |

Health Card |

Ayushman Card |

|

Purpose |

Proof of identity for availing healthcare benefits from various schemes |

Access to cashless treatment under Pradhan Mantri Jan Arogya Yojana (PMJAY) for eligible families |

|

Target Group |

All citizens, depending on the specific scheme |

Economically weaker sections of society as defined by PMJAY criteria |

|

Cost |

Free or subject to a nominal fee as per the scheme |

Free for eligible families |

To apply for the Ayushman Yojana Card in 2024, you need to follow a simple process. This government initiative aims to provide health insurance coverage to vulnerable citizens.

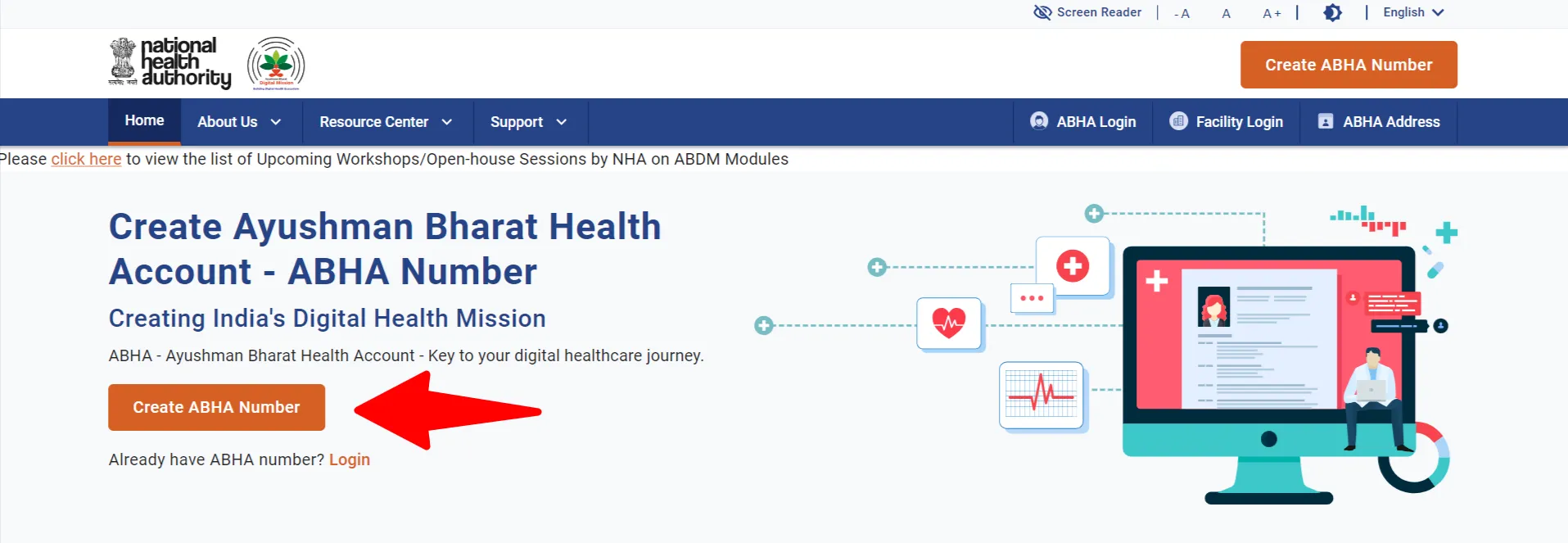

Step 1: Visit abha.abdm.gov.in, and click on "Create ABHA Number"

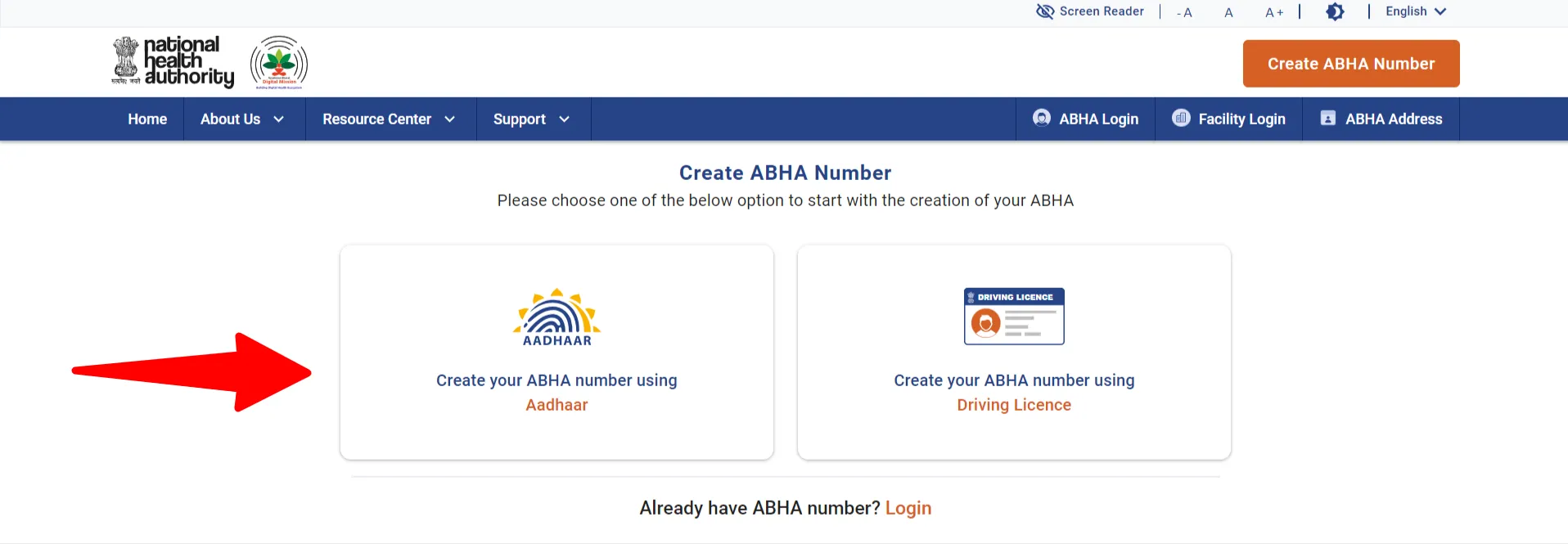

Step 2: Click on "Create your ABHA number using Aadhar".

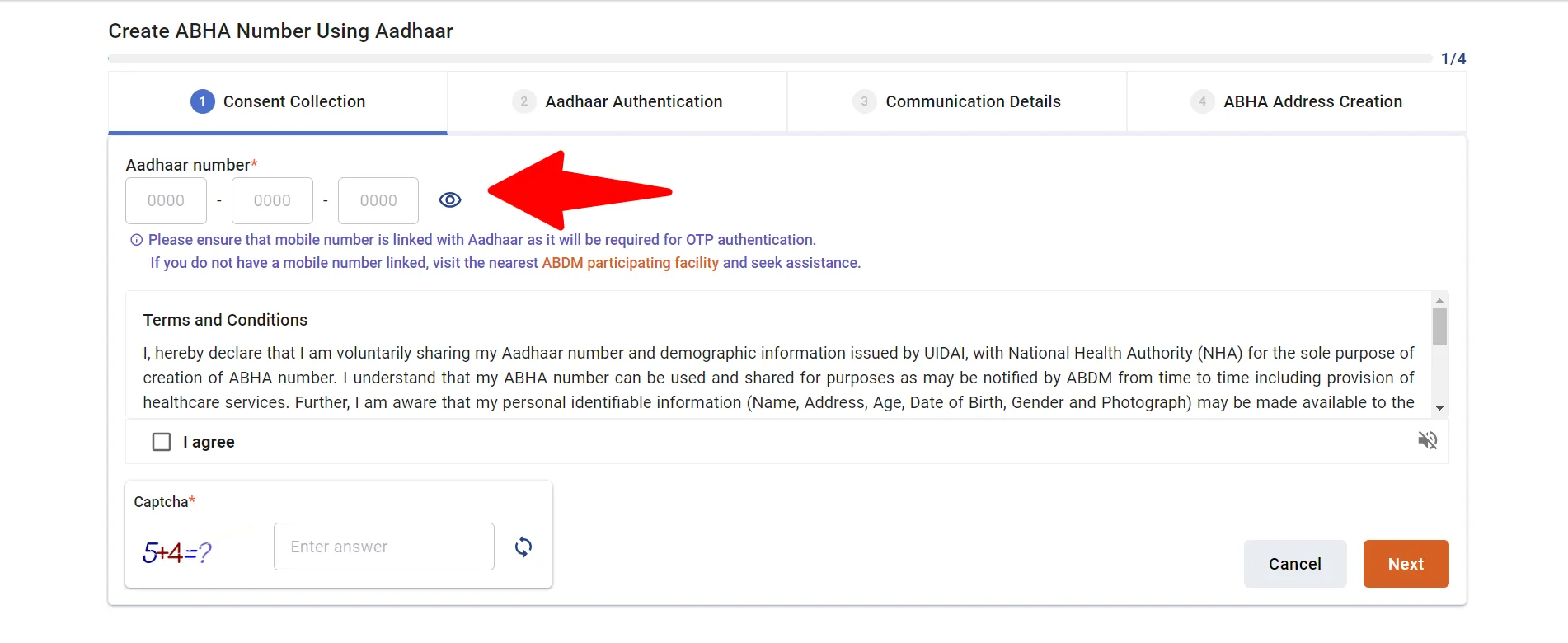

Step 3: Enter your Aadhaar card number, fill in the captcha, and click “Next”.

Step 4: Verify with the “OTP” and, fill in the application form with personal details, and income.

Step 5: Apply and once your application is approved, you'll receive a notification and your Ayushman Bharat Health Account (ABHA) card will be generated.

You can download your Ayushman Bharat card (also known as Pradhan Mantri Jan Arogya Yojana or PMJAY card) in two ways: online or through the UMANG app.

Step 1: Visit the official PMJAY website, on the homepage, click on "Am I Eligible?" in the top menu.

Step 2: Enter your mobile number linked to your Ayushman Bharat account and Click on "Generate OTP", enter the received OTP, and captcha code.

Step 3: Once your identity is confirmed, you'll be redirected to a new page where you can download your Ayushman Bharat card.

Step 4: Click on the "Download Card" option provided on the screen.

Step 5: Your Ayushman Bharat card will be downloaded in PDF format.

Step 1: Download the UMANG app (Unified Mobile Application for Government India) on your phone. It's available on both Android and iOS.

Step 2: Register or log in using your mobile number and Aadhaar card details, and search for "Ayushman Bharat PMJAY".

Step 3: Click on "Beneficiary Status" and enter your mobile number or Ayushman card number.

Step 4: You'll get information about your family's coverage and any previous claims.

Step 5: Click on "Download e-Card" to download your Ayushman Bharat card in PDF format.

Ayushman Bharat Yojana Scheme is primarily based on certain criteria related to economic status. The scheme aims to provide financial protection to economically vulnerable families. Eligibility is determined through the Socio-Economic Caste Census (SECC) data. Here are the key eligibility criteria for Ayushman Bharat Yojana:

• Economic Criteria: Families identified as economically vulnerable based on the SECC data are eligible for Ayushman Bharat Yojana. This data is used to identify households that fall into specific deprivation categories.

• Deprivation Criteria: The SECC data categorizes households based on various deprivation indicators such as housing, education, occupation, and more. Families falling under identified deprivation categories are considered eligible.

• Urban and Rural Areas: The scheme covers both urban and rural areas, and eligible families from both settings can benefit from Ayushman Bharat.

• No Age Limit: There is no specific age limit for eligibility. The scheme covers all family members, including children and the elderly.

The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) aims to provide financial protection to economically vulnerable families in India.

Identity Proof: Aadhar Card, Voter ID, Passport, and any other government-issued photo ID

Address Proof: Aadhar Card, Voter ID, Passport, and Utility bills (electricity, water, gas, etc.).

Family Structure Details: Documents proving family structure, such as a ration card or a family certificate

Income Certificate: Proof of income or a certificate demonstrating economic status. This could include salary certificates, income tax returns, or any other income-related documents.

Caste Certificate: In some cases, a caste certificate may be required as part of the eligibility criteria.

Bank Account Details: A bank account may need to be linked to receive cashless benefits under the scheme.

While the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) aims to cover a significant portion of the population, certain individuals may not be eligible to make an Ayushman Yojana card.

• Higher Income Individuals: The scheme is designed to provide financial protection to economically vulnerable families. Individuals or families with higher income levels may not qualify for the Ayushman Bharat card.

• Non-Indian Residents: The scheme is typically intended for Indian residents. Non-Indian citizens may not be eligible for enrollment.

• Families Not Identified in SECC Data: The Ayushman Bharat scheme uses the Socio-Economic Caste Census (SECC) data to identify eligible families. If a family is not included or identified in the SECC data, they may not be eligible for the Ayushman Yojana card.

Yes, an Ayushman Card can be made without a ration card. The eligibility for Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) is determined based on various socio-economic factors, and possession of a ration card is not a mandatory requirement for enrollment.

The scheme primarily relies on the Socio-Economic Caste Census (SECC) data to identify and include economically vulnerable families. While a ration card is one of the documents that can be used to support the application, individuals and families without a ration card can still apply for and receive the Ayushman Card.

No, the Ayushman Bharat Pradhan Mantri Jan Arogya Yojana does not require annual renewal. Once a family or individual is enrolled and eligible for the scheme, the coverage continues without the need for annual renewal.

The eligibility and enrollment process typically involves verification of socio-economic criteria, and once approved, the Ayushman Yojana Card remains valid for the duration of the scheme. There is no need for beneficiaries to go through a yearly renewal process.